Receive an instant quote for guaranteed issue life insurance by filling out the tool on this page. Right away, you’ll receive quotes from multiple insurance companies for your age and state.

If you are shopping for life insurance for seniors with dementia, or any other high-risk medical condition, you may have questions. Well, you have come to the right place as this website is dedicated to helping people with pre-existing conditions secure affordable guaranteed issue life insurance.

In this article, we discuss life insurance and dementia in-depth. By the time you’re finished reading, you’ll know how dementia affects your ability to qualify for life insurance, the application process, graded period and if there’s an opportunity for instant coverage life insurance.

What You’ll Learn

Can You Get Life Insurance if You Have Dementia?

Qualifying for Life Insurance with Dementia

What Type of Life Insurance Can Someone with Dementia Get?

Guaranteed Issue Life Insurance

3 Best Guaranteed Life Insurance Companies for Dementia Patients

Applying for Life Insurance Coverage with Dementia

Before we begin, let’s be clear about one of the most common questions we get.

Before we begin, let’s be clear about one of the most common questions we get.

Can You Get Life Insurance if You Have Dementia?

Yes! You definitely can receive a guaranteed issue life insurance policy when you have dementia. The best reason for choosing this type of policy is that you will not get turned down. Even with a high-risk, pre-existing condition like dementia.

Qualifying for Life Insurance for Seniors with Dementia

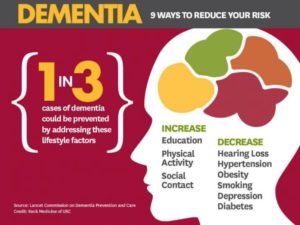

Credit: Keck Medicine of USC via sciencedaily.com

Dementia is actually considered a syndrome caused by a variety of brain illnesses that can affect thinking, memory, behavior and an ability to perform simple everyday tasks. It can be chronic or progressive in nature.

In this article, Dementia and Alzheimer’s will fall into this same category. This is because most life insurance companies will lump them together and treat them identically.

Unfortunately, there is a lot of misinformation on the internet about these two conditions and how they affect life insurance. Which is why we’re glad you’re here!

We’ve worked with customers with almost every high-risk health condition imaginable, including those who are affected by dementia.

Applying for Traditional Life Insurance with Dementia

Dementia and Alzheimer’s are both serious health conditions that can impact a persons life expectancy. The average number of years that someone with dementia will live post-diagnosis is about ten or so. At this time, there are no known treatments to stop the degenerative diseases that cause dementia, although some do help with symptoms.

Due to the severity of these diseases, people suffering from Dementia and Alzheimer’s will receive an automatic decline from insurance carriers when applying for traditional term and whole life policies.

Why Traditional Life Insurance Carriers Decline Dementia Patients

When it comes to life insurance, you will be asked a question similar to this:

Have you ever been diagnosed with, been treated for, or been advised to receive treatment for dementia or Alzheimer’s disease?

If you answer “yes” to this question then you will get a flat decline or a graded period plan.

But what if I say no?

If you say “no” to the dementia health question on the application, they will still find out in another way.

Pro Tip: It is never advised to lie on a life insurance application. Even if you tell the agent you do not have a high-risk condition, the insurance companies will perform a background check and discover it on their own. This will only delay the decline process and show up on your MIB report.

It can come down to your medications.

How Prescriptions for Dementia Affect Life Insurance Qualification

All underwritten insurance policies will run a prescription history check. When they do this, they will be able to spot common dementia or Alzheimer’s drugs.

If you’ve ever filled a prescription for a dementia drug (even if you didn’t take it), you will be deemed a dementia patient. It’s black and white without room for negotiation.

Some of these common drugs include:

- Acetyl L-Carnitine

- Aricept

- Cognex

- Donepezil

- Ergoloid Mesylates

- Exelon

- Galantamine

- Hydergine

- Namenda

- Razadyne

- Reminyl

- Rivastigmine Tartrate

So, in summation, if you have dementia or Alzheimer’s or have taken medication to treat these conditions, you will be declined instantly for an underwritten life insurance policy.

What Type of Life Insurance Can Someone with Dementia Get?

The best choice for seniors with dementia is a guaranteed acceptance whole life policy. This type of life insurance policy is actually made for people with high-risk health conditions like dementia.

Guaranteed Issue Life Insurance with Dementia

The good news is that even with dementia or Alzheimer’s, you will qualify for a guaranteed issue life insurance policy.

Guaranteed acceptance life insurance is commonly referred to as no-questions life insurance. This means exactly what it sounds like–– there are absolutely no medical questions on the application.

These policies are intended for people with high-risk pre-existing conditions.

Who Qualifies for Guaranteed Issue Life Insurance?

The only factors that are considered when applying for guaranteed life insurance include:

- You must be a U.S. citizen

- You must be between the ages of 40-85

- You must reside in a state with product availability

- You must be able to understand what you’re purchasing and sign the application

Yes, it’s that easy! No questions policies are the simplest way of receiving life insurance coverage.

If this is the first page on this website you’ve seen, you may have questions about what a guaranteed acceptance policy is.

Benefits of Guaranteed Life Insurance for Seniors with Dementia

These are the main features and benefits of a guaranteed issue life insurance policy:

- There are no medical questions or exam

- You are guaranteed acceptance

- There are fixed monthly premiums

- The death benefits are guaranteed

- There is an accrual of cash value

- There is no expiration date (i.e. you cannot outlive it)

- There is a mandatory graded (waiting) period

As you can see, this type of life insurance policy is the best option for people with dementia. There is, however, more to it than the simple points above, so we do recommend doing research and working with an expert.

Graded Period with Dementia or Alzheimer’s

A no questions life insurance is always going to be your safest option when you have dementia. However, there is one very important caveat.

Every single company that sells guaranteed issue will impose, at a minimum, a two-year waiting period. This is called the mandatory graded period, which dictates when you will receive full coverage for a natural death.

This means that if death occurs within the graded period, the entire policy amount will not be paid out. Instead, your beneficiaries will receive a return of premiums plus interest. Typically, the total payout is 110% of the premiums that had been paid-to-date.

After the 2-year waiting period is up, then your loved ones are guaranteed the full policy amount. No questions asked.

The exception to the waiting period is if death occurs from an accidental cause, like a car accident. If this happens, the policy amount will be paid regardless of the date (even under the two years).

In our opinion, because of the mandatory graded period, it is always best to receive coverage ASAP. The sooner you can begin working through the graded period, the sooner you can receive coverage. Also, the monthly premium of your policy is determined based on your age, and we all know we’re not getting any younger.

The Best Guaranteed Issue Life Insurance Companies for Dementia Patients

When you have dementia or Alzheimer’s, it’s important you select a guaranteed issue life insurer that has the shortest possible graded period. No matter what, this will be 2 years. The second factor you’ll most likely consider is cost, which varies depending on your age and insurance company.

Pro Tip: The best guaranteed acceptance life insurance plan is one that costs you the least every month and only has a two-year graded period.

Although there are dozens of companies that offer no questions policies, there are a few standout options.

Our top choices include:

- AIG (Corebridge Financial)

- Gerber Life

- Great Western Insurance Company

These companies offer the best combination of price, state and age availability, as well as living benefits. If you would like help sorting through these options, you can either read more in their links above or call us directly and we can help you identify the best match.

Did you know that your exact birth date is what will determine the price across all carriers? You can quickly find out what your rates would be today by using the free quote tool on this page.

Applying for Life Insurance Coverage with Dementia

At this point, you know that guaranteed issue life insurance is your best and only option for dementia and Alzheimer’s. Yet maybe your case is not so black and white, perhaps you’ve been given another neurological diagnosis or are unsure if you should get life insurance.

We understand that shopping for insurance can be tricky, but ultimately, everyone needs coverage. Unless you have another policy or a large savings account to pass along to your beneficiaries, you should absolutely apply for protection.

Remember, the sooner the better because of the 2-year graded period!

So how do you apply?

It’s simple.

Work with an Independent Life Insurance Agency

Applying with the help of an independent agency (like us) will provide you with options from more than one insurance company. Ultimately, this will help you secure the right plan for you and your family’s financial goals.

Working with Guaranteed Issue Life will give you access to agents licensed in every state who are also very familiar with high-risk conditions like dementia. We’re proud to say that our success rate in placing applicants with dementia is very high. We’ve been able to give these folks the peace of mind they desire and deserve.

If you are ready to move forward with an affordable life insurance for seniors with dementia, give our office a call. You can also run an instant quote for your age using the free quote tool on this page. We look forward to working with you soon!

Speak with an experienced advisor!

Speak with an experienced advisor!