Use the free quote tool on this page to view custom pricing from multiple insurance companies who offer HIV life insurance.

If you’re in the market for life insurance and have tested positive for HIV or diagnosed with AIDS, this article is for you. Both HIV and AIDS are considered high-risk conditions that can make qualifying for traditional life insurance difficult.

Fortunately, there is life insurance available for people with HIV or AIDS. Below we will show you:

- How HIV and AIDS affect your ability to qualify for life insurance

- What types of insurance are available, including the 3 best companies.

- How to find & apply for affordable life insurance with HIV or AIDS.

Quick Navigation

Can You Get Life Insurance if You are HIV Positive or Have AIDS?

About HIV

How Life Insurance Carriers View HIV & AIDS

About Guaranteed Issue Life Insurance for HIV & AIDS Patients

3 Best Life Insurance Companies for People with HIV or AIDS

How to Apply for Life Insurance with HIV or AIDS

First, let’s be clear about a common question we get from people who are HIV positive or have AIDS.

Can You Get Life Insurance if You are HIV Positive or Have AIDS?

Yes! While your options will be limited, you can still qualify for life insurance.

For most people with HIV or AIDS, the best option is called a Guaranteed Issue Life Insurance Policy, which is specifically designed for people with high-risk medical conditions like HIV.

If you’ve tested HIV positive and/or been diagnosed with AIDS, you cannot qualify for traditional term or whole life insurance.

When we say traditional, we mean any life insurance policy that includes medical underwriting. These types of plans will require medical questions in the application and may even perform a medical exam. If you have HIV or AIDS, you will have an immediate decline.

About HIV

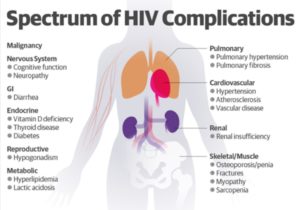

HIV (human immunodeficiency virus) is a virus that attacks the immune system, which is the body’s natural defense system. In the United States, there were an estimated 37,600 new HIV infections in 2014. This is a decline of about 10% from 2010.

In 1996, the total life expectancy for an infected 20-year-old person was 39 years. In 2011, the total life expectancy bumped up to about 70 years. Someone who is HIV positive, receiving treatment, and in optimal health — meaning they don’t do drugs and are free of other infections — may live to be in their late 70s.

How Life Insurance Carriers View HIV & AIDS

All insurance agents will ask if you are HIV positive or have AIDS. This is a standard “knock out” question in the application process.

Regardless of how well-controlled a person’s HIV is, they are instantly deemed uninsurable by all carriers for traditional life insurance.

This may change in the future as the life expectancy continues to improve and the prevalence decreases, but for now, this is the case.

Pro Tip: Always be completely honest when answering health questions with an insurance agent. It is illegal to lie about your health status, and insurance carriers will find out through their own discovery process of all your health issues prior to issuing a policy.

Guaranteed Issue Life Insurance for HIV & AIDS Patients

As we mentioned above, the best, and only option for people living with HIV or AIDS is a high-risk guaranteed acceptance life insurance policy.

This policy will provide your loved ones with protection once you pass that assists with any final expenses. These expenses may include outstanding medical bills, debt, household expenses, etc.

A guaranteed acceptance policy is still considered a whole life policy, which means it will stay in place until you pass.

The main features of a guaranteed issue life insurance policy include:

- No medical questions or exam

- Guaranteed acceptance

- Fixed monthly premiums

- Guaranteed death benefits

- Accrual of cash value

- No expiration date (you cannot outlive it)

This type of policy is an excellent choice for anyone with a high-risk condition like HIV or cancer, especially if loved ones do not have the financial security to pay for final expenses.

The waiting period is the primary con to this type of policy, and it’s important that you understand it before purchasing.

How the Graded Period Works

The number one drawback to a guaranteed acceptance policy is the mandatory waiting period. Typically this period is a minimum of two years and is the amount of time you must live in order for the policy to be paid-in-full.

The reason for this is because the insurance companies must protect themselves from people who are very near death from “abusing the system.”

If death occurs during the waiting period, all life insurance carriers will refund your premiums plus interest. This interest is typically around 10%. After the two years have passed, you are protected in full.

The only exception to this is if death occurs by accidental means, such as a car accident. When this happens, the entire policy amount will be paid as long as the accidental cause of death can be proven.

3 Best Life Insurance Companies for People with HIV or AIDS

Now you may be wondering what the best carrier is for guaranteed acceptance life insurance. The best option always depends on your unique situation. Factors like state availability, graded period duration, affordability, your age, and living benefits all play a role.

However, there are three guaranteed acceptance carriers that we most often recommend based on cost, benefits, and availability for most people. Each of these companies offers a policy with coverage from $5,000 to $25,000 in coverage, and a two year waiting period.

For more info & rates, click on the company.

We recommend using the free insurance quote tool on this page to instantly run a quote for your age, state, and coverage amount so you can compare other companies as well.

Apply for Life Insurance with HIV or AIDS

If you have been diagnosed with either HIV or AIDS and think you might need life insurance, it’s best to apply as soon as possible. Your life insurance rates will increase with every day that passes.

Fortunately, it is very easy to apply and only takes around 10 minutes. You can actually have coverage in less than 24 hours. All you need to apply is your and your beneficiaries’ personal information and preferred payment method.

Once your application has been accepted, you will begin working through the two-year waiting period.

Find The Best Life Insurance Policy

To find the best guaranteed life insurance policy, you’ll want to compare multiple life insurance companies. Most guaranteed issue policies are very similar, so comparing and finding the cheapest rate is usually the best option.

As an independent agency, it is our job to look at your unique situation and determine which companies will offer you the best deal and fit your individual situation.

We’ve worked with 1000’s of clients, including people with HIV and AIDS, to compare life insurance carriers and find affordable policies, all at no charge.

Start by filling out the quote tool on this page, then give us a call to find the best life insurance with HIV or AIDS. We look forward to working with you soon!

Speak with an experienced advisor!

Speak with an experienced advisor!