Instantly run a quote for your birth date and see prices from many insurance companies on the next page. The tool on this page is the easiest way to see how much a guaranteed issue life insurance policy will cost you today.

Shopping for life insurance with a pre-existing condition can be daunting. This includes finding life insurance for dialysis patients. Since receiving insurance protection is heavily dependent on one’s current health standing, being on dialysis can make the process more complicated.

In this article, we discuss how you can get life insurance while on dialysis. Whether you are suffering from chronic or end-stage kidney failure, you’ll walk away knowing what kind of insurance is best for you. You’ll also know what a life insurance agent will ask during the application, information about graded periods and how to apply.

What You’ll Learn

Can You Get Life Insurance If You Are On Dialysis?

Types of Life Insurance for Dialysis Patients

About Guaranteed Issue Life Insurance

Top 3 Life Insurance Companies for Dialysis Patients

Applying for Life Insurance for Dialysis Patients

Now before we dive in let’s answer a common question about life insurance for people with kidney disease.

Now before we dive in let’s answer a common question about life insurance for people with kidney disease.

Can You Get Life Insurance If You Are On Dialysis?

Yes! You may have been declined for life insurance in the past because of dialysis, but know that you can 100% get insurance protection in the form of guaranteed issue.

The #1 benefit to this type of insurance is that you cannot get turned down, even with a high-risk, pre-existing condition.

Types of Life Insurance for Dialysis Patients

You may be wondering if you can qualify for life insurance with kidney failure or on dialysis.

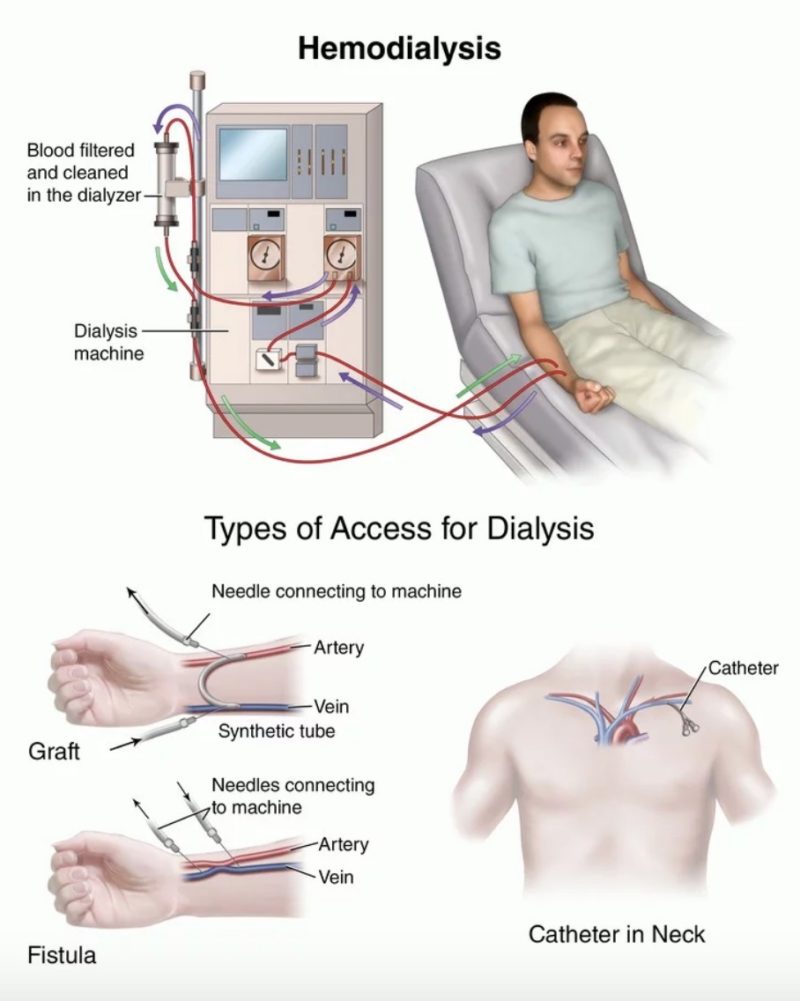

Credit: summitmedicalgroup.com

Well, let’s get right to it.

The truth is when you apply for a traditional type of life insurance policy on kidney dialysis, you will receive an automatic decline across all carriers. This is due to of the medical underwriting process when carriers determine your risk level and eligibility.

Insurance companies do this by asking health-related questions, conducting a personal health inquiry, and sometimes requiring medical exams.

Typically the questions asked during an application include:

- Have you ever received or been advised to receive kidney dialysis?

- Within the last 12 months, have you ever received or been advised to receive kidney dialysis?

If you answer “yes” to either of these questions, you will be denied coverage for traditional term or whole life insurance. It is too risky for an insurance company to take on a customer being treated for a condition that decreases life expectancy.

So what life insurance policies are available to someone on dialysis?

The type of life insurance policy that a person on dialysis can qualify for is one that does not ask any medical or health questions. These policies are called guaranteed acceptance life insurance, or guaranteed issue life insurance, and are offered without asking any health questions whatsoever.

Guaranteed Issue Life Insurance for Kidney Dialysis Patients

Guaranteed issue life insurance is also commonly referred to as no-questions life insurance or guaranteed issue burial insurance. This essentially means that there are zero medical questions on the application. In fact, you are not required to disclose that you’re on dialysis.

These types of policies are meant for customers with pre-existing conditions that are high risk.

These types of policies are meant for customers with pre-existing conditions that are high risk.

When you apply, the only factors that are considered include:

- You must be a U.S. citizen

- You must be between the ages of 40-85

- You must live in a state with availability

Seriously, that’s it! This is hands down, the easiest and most unobtrusive way of applying for and receiving life insurance when you’re on dialysis.

About Guaranteed Issue Life Insurance Policies

If a guaranteed acceptance life policy is new to you, these are the most common features that make it unique:

- Guaranteed death benefits to beneficiaries

- You’re guaranteed acceptance when you apply

- There are no medical questions or exam

- Enjoy fixed monthly premiums

- There is an accrual of cash value

- You cannot outlive it

- There is a mandatory graded period

Drawbacks to Guaranteed Issue Life Insurance with Kidney Failure

When a guaranteed acceptance life insurance policy is the only choice for a customer with a high-risk condition, there are two pertinent facts to know in advance.

The two largest drawbacks for this type of insurance policy are the mandatory graded period and the cap on policy coverage amounts.

Let’s dive into the first one.

The Graded Death Benefit

Every policyholder of a guaranteed issue life insurance policy is faced with a graded death benefit. This is the required waiting period you must outlive in order to qualify for full coverage. Typically, this waiting period is 2-years but is as high as 2.5 years with some carriers.

If a policyholder dies during the graded period from natural causes, such as kidney failure, the beneficiaries will only be paid the premiums paid-to-date plus some interest. The interest given is typically 10% to help with final expenses, which means 110% of premiums will be paid to the beneficiaries.

There is one exception to this and that is if death occurs from an accident. For example, let’s say you are in a car accident during the graded period. If this happens, your beneficiaries will actually receive the full policy amount.

Pro Tip: It’s really important to begin working through the graded period as quickly as possible. This is in yours and your beneficiaries best interest. When you’re on dialysis, it would be a very smart choice to get coverage ASAP.

The faster you’re able to get through the two years, the faster your family will receive full protection.

Dialysis Patients Usually Get Limited Coverage Amounts

Because of how guaranteed issue life insurance policies work, the best insurance companies can only offer a set amount of coverage. Usually, a no questions policy will have an upper limit of $25,000 in protection for people on kidney dialysis. In our professional experience, this amount will cover the majority of final expenses, like cremation or burial services, and other small loose ends.

A policy maxed out at $25,000 may not be enough to take care of higher medical bills or other outstanding debts, but something is always better than nothing for your loved ones. The majority of our customers on dialysis do agree that some coverage is far superior to no coverage.

Top 3 Life Insurance Companies for People on Dialysis

Every situation is unique so it is best to work with an expert to find the best guaranteed issue life insurance policy for your needs. That said, we typically recommend policies from these 3 life insurance carriers.

- AIG (Corebridge Financial)

- Gerber Life

- Great Western Life

Again, there are scenarios where we recommend other life insurance policies, but with those 3 companies, you usually cannot go wrong. Contact us to find out if one of these companies is the best for you.

Applying for Life Insurance for Dialysis Patients

If you have end-stage kidney failure and are on dialysis, it’s important that you apply for a guaranteed acceptance life insurance policy ASAP.

The easiest and most effective way to do this is by working with an independent agency. When you go with an independent agency, you’ll work with agents that are licensed with many carriers, not just one.

This means that you’ll be given multiple options and have the power to choose what is best for you. You may decide that the most affordable plan is right for you or one with slightly higher premiums that also comes with living benefits. The choice, ultimately, is yours and only an independent agent can give you those options.

Find The Right Life Insurance After Kidney Failure

We can’t stress enough how important it is to get coverage right away if you’re on dialysis. The graded period is non-negotiable and each passing day is another day that could count toward it.

You may not feel prepared to make this decision yet, and we completely understand. This is why we have experienced agents available to answer any questions you may have. You do not need to go through this process alone.

If you have questions or would like to move forward, you can call us directly and speak with an agent licensed in your state.

An Independent Life Insurance Agency Experienced with Dialysis Patients

We are a highly experienced, independent insurance agency that represents dozens of quality carriers. Our agents are licensed in every state and qualified to work with a variety of clients, including those on dialysis with kidney failure.

We’re very proud to share that we’ve placed countless policies successfully for those with a high-risk health concern. We’ve helped more families than we can count achieve the peace of mind they crave and financial security.

Find the right life insurance for your situation by calling today!

Not quite ready? No problem.

You can also get a free custom quote using the tool on this page. Simply enter how much coverage you’re interested in, your birthdate, and state. You’ll instantly be presented with rates across multiple guaranteed acceptance life insurance carriers to find the best life insurance for dialysis patients.

If you like the prices that you see, we can help facilitate an application for you at absolutely no charge. You might be surprised just how simple and fast it can be when you work with Guaranteed Issue Life.

Speak with an experienced advisor!

Speak with an experienced advisor!