You can receive instant guaranteed issue insurance quotes by filling out the quote tool on this page. You will see prices from highly rated life insurance companies that offer life insurance for people with chf in your state.

Shopping for life insurance with congestive heart failure or another pre-existing condition can be daunting. Since receiving protection is heavily dependent on one’s current health standing, a condition like congestive heart failure makes the process more complicated.

Luckily, you can still find affordable life insurance with CHF, if you know what to look for.

What You’ll Learn

Can you Get Life Insurance with CHF?

About Congestive Heart Failure

Qualifying for Life Insurance with CHF

Guaranteed Life Insurance with Congestive Heart Failure

3 Best Life Insurance Companies for Heart Failure

How to Apply for Life Insurance with CHF

Below you will learn exactly how congestive heart failure plays a role in a persons ability to qualify for insurance, as well as what a life insurance agent will look for during the application, what graded period to expect and if there’s an opportunity for non-guaranteed issue coverage.

Can You Get Life Insurance with Congestive Heart Failure?

Yes, rest assured that you can receive life insurance coverage with congestive heart failure.

The type of policy most people get is called guaranteed issue life insurance. The main benefit of this type of insurance is that you cannot get turned down, even with a high-risk, pre-existing condition.

About Congestive Heart Failure

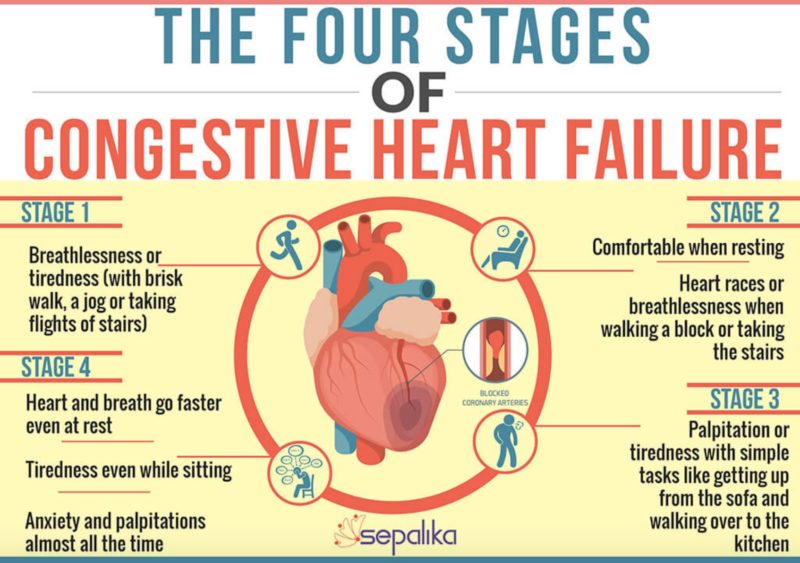

Congestive Heart Failure (CFH), also known as heart failure or cardiac failure, is a condition in which the heart’s function as a pump is inadequate to meet the needs of the body. In the United States, approximately 5.7 million adults are suffering from some degree of heart failure. CFH affects people of all ages, from children and young adults to the middle-aged and the elderly.

CFH is a “symptom” that can be caused by a variety of health conditions. It is typically the end result of another type of heart condition which, over time, can weaken or “stiffen” the heart to the point where it no longer works properly.

Medical conditions that can cause one’s heart to fail

- Coronary artery disease (atherosclerosis)

- High blood pressure (hypertension)

- A heart attack

- Faulty heart valves

- Cardiomyopathy

- Myocarditis

- Congenital heart defects

- Arrhythmias

- Diabetes

- HIV

- Hyperthyroidism

- Hypothyroidism

- Hemochromatosis

Since CFH is the result of other conditions, it can technically be reversed. If the underlying condition is addressed, then a person may no longer suffer from CFH. Because of this, it is important to understand why someone has CFH before recommending a particular type of life insurance policy.

Qualifying for Life Insurance with Heart Failure

It is common for the majority of people with CFH to get consistently declined by insurance companies. This is usually because they are not applying for the right type of policy given their pre-existing condition. Good agents should tell you before you even fill out an application that you will get declined due to congestive heart failure.

What you need to know, though, is that you can 100% get insurance coverage with congestive heart failure. It is just a matter of what type of policy you apply for.

If you are applying for life insurance that has medical underwriting, there is a very high likelihood that you’ll be declined. Since CFH is a very serious medical condition, upwards of 95% of carriers will decline altogether and end the conversation.

What they won’t tell you is that you can definitely qualify for a guaranteed acceptance policy that provides full protection after two years. This is the exact type of policy that we specialize in at Guaranteed Issue Life. With a guaranteed issue policy you do not need to deal with any medical exams, health questions or a lengthy application process.

Guaranteed Life Insurance for Someone with CHF

Guaranteed issue life insurance is also known as no-questions life insurance, which means that there are zero medical questions on the application. In fact, you do not even need to disclose that you have congestive heart failure.

These policies are intended for people with high-risk pre-existing conditions.

The only factors that are considered when applying include:

- Must be a U.S. citizen

- Between the ages of 40-85

- State availability

That’s literally it! Hands down, it is the simplest, easiest and most unobtrusive method in receiving life insurance protection.

What Exactly is Guaranteed Issue Life Insurance?

If this is your first time learning about guaranteed issue life insurance, here are the main features of guaranteed issue life insurance policies across all carriers:

- No medical questions or exam

- Guaranteed acceptance

- Fixed monthly premiums

- Guaranteed death benefits

- Accrual of cash value

- No expiration date (you cannot outlive it)

- A required graded period

Guaranteed Policies have a Waiting Period

Since guaranteed issue life insurance is going to be your best option when you have congestive heart failure, there is one important caveat.

You will be required to wait through the mandatory graded period before qualifying for full coverage. This graded death benefit is a clause that limits when your policy will actually begin to cover you for losses due to natural causes of death.

Typically the graded period is 2-years, but sometimes it is as high as 3.

If death occurs during this timeframe from natural causes, such as complications from congestive heart failure, the full policy amount will not be paid. Instead, your beneficiary(s) will receive the premiums paid plus interest. Typically this interest is 10% of all the monthly premiums paid-to-date.

Exception to the Graded Period

There is one exception to this and it’s if death occurs from accidental causes, such as being struck by a motor vehicle. If this is the case, then the full policy amount is guaranteed even within the 2-year graded period.

In light of the required graded period with guaranteed issue life insurance, we highly recommend you receive coverage as quickly as possible. This is so you can begin the clock on the two years today. Another big incentive is to ensure your policy is as affordable as possible. Since the price you pay is heavily dependent on your attained age, typically today will be your most affordable day.

3 Best Guaranteed Life Insurance Companies for Congestive Heart Failure

If you’re wanting to learn more about specific companies and policy features you can get with CHF, we recommend starting with these 3 companies.

- AIG (Corebridge Financial)

- Gerber Life

- Great Western Life

Depending on your situation another company might be a better fit, but those are typically the best options. Fill out the form on this page and give us a call to find the best life insurance company for you.

How to Apply for Life Insurance with Congestive Heart Failure

If you have congestive heart failure, we highly suggest you work with an independent agency. This condition can be complex and it is important you know what all your options are. Since there is no life insurance company that fits the needs of everyone, an independent agent can help find the right one for you.

If a guaranteed issue policy is the right option for your unique circumstances, you will undergo a very simple application process.

In order to apply, all you will need is yours and your beneficiary(s) personal information (such as birth date, address, phone number, etc.), and how you prefer to pay. It’s that simple!

There is no need to answer medical questions or wait for an answer. The process takes minutes and you are guaranteed coverage.

Working with Guaranteed Issue Life

We are an independent agency that represents dozens of life insurance carriers. Our licensed agents are qualified to work with customers in every state and are very knowledgeable about congestive heart failure and life insurance.

We’ve successfully placed 100’s of people with congestive heart failure and other high-risk medical conditions in policies that protect their families financial security.

If you feel ready to secure the most affordable life insurance for someone with congestive heart failure, give us a call today. You can also run an instant quote for your age using the free quote tool on this page.

Speak with an experienced advisor!

Speak with an experienced advisor!