Did you know that you can receive instant guaranteed issue insurance quotes by filling out the quote tool on this page? You will see prices from many insurance companies that offer quality life insurance for people with COPD in your state.

If you are shopping for life insurance with COPD or other pre-existing conditions, you’ve come to the right place. On this website, we cover how to effectively shop for guaranteed acceptance life insurance for many common pre-existing conditions.

This article discusses COPD and life insurance in a comprehensive way. By the end, you will feel comfortable knowing:

- How COPD affects a person’s ability to qualify for insurance coverage.

- What carriers look for in an application.

- The right types of life insurance policies for seniors with COPD.

What You’ll Learn

Can I Get Life Insurance with COPD?

About COPD

How Life Insurance Companies View COPD

Guaranteed Issue Life Insurance with COPD

Other Life Insurance Options for COPD

How to Apply for Life Insurance with COPD

First, let’s be clear on whether you can even get life insurance for seniors with COPD.

Can I Get Life Insurance with COPD?

You absolutely can receive life insurance coverage with COPD.

Even with severe COPD you can still qualify for guaranteed issue life insurance. The biggest draw to a guaranteed issue policy is that you cannot get turned down, even with a high-risk pre-existing condition like COPD.

About COPD

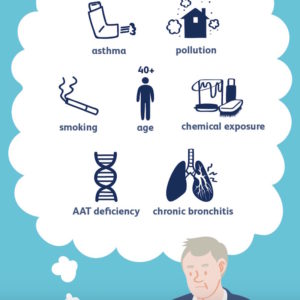

Chronic Obstructive Pulmonary Disease, or COPD, refers to a group of high-risk diseases that cause airflow blockage and breathing-related problems. It includes emphysema, chronic bronchitis, and in some cases asthma.

Common symptoms include:

- Trouble breathing

- Difficulty engaging in physical activity

- Need for portable oxygen tanks

- Confusion or memory loss

- Decreased quality of life

COPD Statistics

Surprisingly, lower respiratory diseases are the third leading cause of death in the United States, which can cause problems when shopping for insurance. It most commonly affects seniors between the ages of 65 and 74, as well as those who are older. Not surprisingly, smokers have higher mortality rates when diagnosed with COPD, up to 13x more.

Although an estimated 12.7 million U.S. adults have been diagnosed with COPD, research suggests that it is highly underdiagnosed. Some reports say that more than 50% of adults with low pulmonary function were not aware they had COPD.

If you have COPD, you’re more vulnerable to the common cold, influenza, and pneumonia. COPD also increases the risk of developing pulmonary hypertension, which is high blood pressure in the arteries that serve the lungs. Other complications from COPD include heart disease and depression. If you’re a smoker who has chronic bronchitis, you’re at increased risk of developing lung cancer.

How Life Insurance Companies View COPD

As the third leading cause of death in the U.S, COPD is not viewed favorably by insurers.

Typically, COPD is considered high-risk by life insurance carriers. This does not mean you are uninsurable for a policy, but your ability to qualify depends on a variety of factors.

Life Insurance Application Questions to Expect with COPD

The questions that you’ll be asked in regard to your COPD include:

- What age were you diagnosed with COPD?

- Is your COPD due to asthma, chronic bronchitis, or emphysema?

- What medications do you take?

- Do you use tobacco or nicotine products?

- Electrocardiographic (ECG) findings

- Have you been hospitalized for COPD?

(source: Rootfin COPD Life Insurance Study)

Qualifying for Traditional Life Insurance with COPD

When applying for life insurance, it’s almost always best to purchase an underwritten policy if you can qualify. We’ll explain why below.

If by medical standards, you are considered a well-controlled COPD patient, you may be able to qualify for a rate class that is below Standard in a fully underwritten policy. This does mean, however, that you’ll have to undergo a medical exam in order to receive coverage, as well as have your medical and pharmacological histories pulled.

A well-controlled patient is one that does not use tobacco products and is able to control their COPD with the use of medication while having no recent hospital visits due to complications.

If you and your doctor consider your COPD moderate, you’ll most likely receive a Substandard rate class or even be declined for a fully underwritten policy. In this case, guaranteed issue life insurance might be your best option.

Furthermore, for those on oxygen, you’ll definitely receive an instant decline by each insurer for non-guaranteed insurance. The only option at that time is a guaranteed issue policy.

Guaranteed Issue Life Insurance for People with COPD

If you have already been declined in the past or have severe COPD, then a guaranteed issue policy is your best option.

Fortunately, this is our wheelhouse of insurance specialties at Guaranteed Issue Life and we cover it in great detail.

With a guaranteed issue policy, you will not need to take a medical exam, answer any health questions, or even fill out a lengthy application. Even elderly seniors who have severe COPD can qualify for this type of policy.

However, rates are higher than a traditional policy, and you will have a waiting period.

The Life Insurance Waiting Period with COPD

When you receive a guaranteed issue policy, you will be required to undergo a mandatory graded period.

This is the length of time you must survive so that your policy payout is guaranteed to your beneficiaries. In our experience, the majority of policies have a two-year waiting period, with a few as high as 3 years.

What does this mean for you?

If you die within the first two years (or three depending on the carrier), your loved ones will only receive a partial payout. They will always get the premiums paid-to-date plus some sort of interest. Typically, this interest is 10%.

Another way of looking at it is that your loved ones will receive 110% of the premiums to help cover final expenses.

The Best Guaranteed Issue Life Insurance Companies for COPD Patients

Every guaranteed issue policy is different, and you have to do your homework or work with an expert to find the best policy for you. That said, we typically find that 3 life insurance companies stand above the rest when it comes to guaranteed policies.

- AIG (Corebridge Financial)

- Gerber Life

- Great Western Life

These are the companies we recommend more than any others for their strong financial ratings, customer support, low rates, and excellent policy features.

Fill out the form on this page and call us to see if one of those companies has a good policy for you.

Other Life Insurance Options for Someone with COPD

If you do not have moderate to severe COPD and have not been declined for coverage in the past, you may qualify for non-guaranteed issue life insurance.

This is usually the better option if you can qualify.

If you do qualify for non-guaranteed issue coverage you can avoid the mandatory graded period and have instant coverage. The chances are that your monthly premiums will be more expensive, but it is always worth looking into.

As we discussed in the section above, this option is only available to those with mild and well-controlled COPD. If you believe you fall into this category, it is best to discuss your options with an independent agent who understands how different life insurance carriers view COPD.

The truth is, all carriers view high-risk insurance conditions differently and therefore have their own set of guidelines and questions. It would be a very lengthy and frustrating process to determine these on your own, which is why an independent agent may be your best tool while shopping.

How to Apply for Life Insurance with COPD

If you have COPD or Emphysema, we highly suggest working with an independent agent. Due to the high mortality rate and prevalence of the condition, all life insurance carriers will look at you differently.

In fact, not all quality life insurance companies will even be a good fit for you. There are hundreds of insurance products on the market and it can be difficult to know which one is the best option for your unique circumstances.

In order to make the process as simple as possible, many carriers have a specialty, and we understand which ones work best for people with COPD.

If you are ready to move forward with securing the most affordable life insurance plan with COPD, give us a call today to start comparing quotes from multiple companies. You can also run an instant quote for your age using the free quote tool on this page.

Speak with an experienced advisor!

Speak with an experienced advisor!